The Truth Behind the Comparison: Are Indian Startups Falling Short of China’s?

- Milind Soni

- April 17, 2025

- Blog

- #AIforProductLeaders, #ArtificialIntelligence, #b2b, #founders, #funding, #gotomarketstrategy, #productmanagement, #productstrategy, #startups, #TechForBusiness

- 0 Comments

At the recent Startup Mahakumbh, Union Minister Piyush Goyal offered a striking comparison between Indian and Chinese startups. While his remarks were likely meant to stir ambition and urgency, they sparked more discomfort than inspiration.

“Food delivery apps turning youth into cheap labor, while China builds electric vehicles.”

“We’re busy with ice cream, reels, and betting apps, while China is investing in AI, semiconductors, and deep tech.”

Sounds brutal. But is this comparison really fair? Or is it overlooking the deeper context behind why Indian startups build what they build?

Entrepreneurs Build What the Ecosystem Supports

Startups don’t grow in a vacuum. They evolve based on the incentives around them — capital, infrastructure, consumer behavior, and policy support. If India’s startup ecosystem is more tilted toward consumer tech like food delivery or fantasy sports, it’s not because our entrepreneurs lack ambition. It’s because that’s where the money is.

And we’ve seen this firsthand.

At ProdZen, We Work Closely With Startups — And We Get It

At ProdZen, we’ve had the privilege of working hand-in-hand with some of India’s most driven founders — across SaaS, AI, fintech, agri-tech, and beyond. We don’t just observe trends; we help shape product strategies, unlock growth bottlenecks, and guide these builders through the chaos of product-market fit.

And what we’ve learned is simple but powerful. Our founder Kaustubh Patekar, (mentor to NASSCOM DeepTech Club) says:

“Indian founders are not lacking ambition — they are navigating constraints.”

From policy hurdles and capital limitations to a relatively slower corporate tech adoption — they are constantly innovating within the system they’re given. And yet, they continue to push boundaries and chase global opportunities.

1. Consumer Spending Dictates Innovation

Let’s start with the fundamentals: consumer demand.

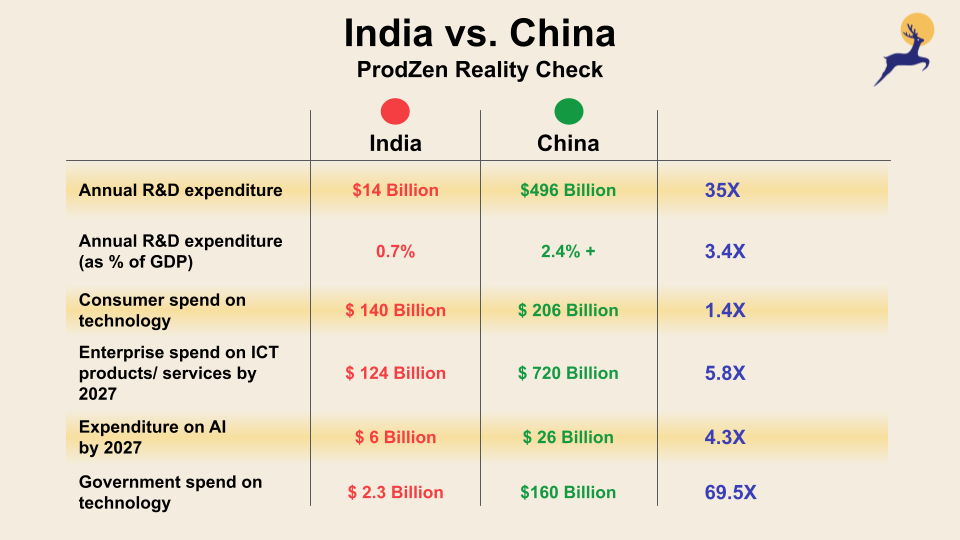

That’s a significant difference — but it still shows a healthy appetite in India for digital experiences, entertainment, e-commerce, and mobile-first services. Naturally, startups follow where consumers are spending.

It’s also why consumer-focused tech — food delivery, fintech, D2C brands, OTT — dominates Indian startup activity. That’s where both usage and money are concentrated.

In India, a massive portion of consumer spend still flows into food and entertainment. Food delivery platforms alone add an annual burden of ₹12,000 crore (~$1.398B) on Indian households.

Meanwhile, deep-tech or industrial tech startups struggle to find local customers because:

- Most Indian corporations are not aggressive tech adopters.

- There’s minimal local demand for advanced automation or robotics.

- B2B tech products often need to be built for Western markets to gain traction.

2. Enterprise Tech Market: The Real Gap in Corporate Spend on Tech

Here’s where things start to diverge sharply:

- Enterprise spend on ICT products & services by 2027

Let that sink in. The enterprise tech market in China is almost 6X larger than India’s.

This directly impacts how many B2B tech products, platforms, or deep-tech startups can scale in India. Most Indian enterprises are still digitizing basic workflows — very few are deploying advanced robotics, ML, or full-stack cloud-native solutions at scale.

So Indian startups that are building SaaS, DevTools, infra, or AI solutions? They’re mostly building for the West, where the market maturity and budgets exist.

India’s IT sector contributes a robust 7.5% of GDP and is projected to hit 10% by FY25. However, much of this is service-oriented — outsourcing and IT management for global clients.

Real tech product innovation, especially for domestic markets, is still limited. If Indian corporations aren’t investing in AI, robotics, or infrastructure software, why would local startups build for them?

3. Expenditure on AI: Not Even Close

Artificial Intelligence — the buzzword of the decade — also paints a telling picture:

That’s more than 4 times the investment. Combine this with China’s aggressive push in AI infrastructure, education, and public-private collaboration, and it’s easy to see why their AI ecosystem looks like an industrial machine — while ours feels like a startup play.

4. Government Backing: Who’s Really Investing?

If we want deep-tech startups, we need deep-tech infrastructure. But here’s the reality:

China’s annual government spend on tech is almost 70X that of India.

This isn’t just support — it’s strategic investment at a national level. From space tech to chips, from 6G research to green hydrogen, China’s state involvement acts as a massive demand and funding engine.

In contrast, India’s tech policy still plays catch-up — with limited funding, unclear procurement pathways for startups, and fragmented implementation across ministries.

While China pours billions into AI, semiconductors, and space tech, India’s allocation for IT and Telecom in the 2024–25 budget was just 2.5% of total expenditure. The IndiaAI mission, a bold step, received only 0.22% of the total budget.

This signals ambition — but not urgency.

If we want deep-tech startups, we need deep-tech infrastructure. That means:

- Better public funding for R&D

- Easier access to labs, testing facilities, and prototyping grants

- Strategic procurement from Indian startups by government and PSU sectors

5. R&D Spending: India vs China — A Glaring Gap

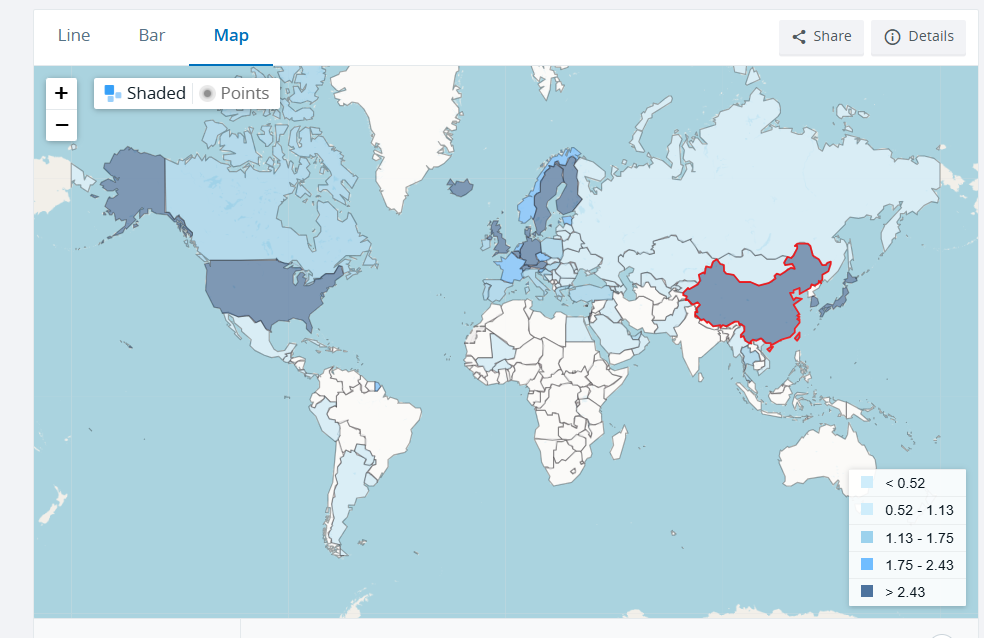

Innovation doesn’t thrive on ambition alone — it needs capital, talent, and long-term commitment. And that’s where India still lags significantly. India’s R&D spending has doubled in the past decade to ₹127,380 crore. That’s progress. But in the global context, it’s still a trickle.

Let’s look at the annual R&D expenditure:

- India: $14 Billion

- China: $496 Billion

That means China invests 35x more into research and development every year than India. When you consider it as a share of national output, the contrast is just as stark:

To put it bluntly:

China’s annual R&D expenditure has crossed US$496 billion — roughly equal to the entire Union Budget of India.

This isn’t just about who’s spending more — it’s about who’s serious about owning the future and this gap is not just a number — it’s a signal. A signal to entrepreneurs, investors, and academics that building foundational tech in India is a long, lonely road.

While India debates incentives and policies, China is building an innovation engine powered by massive, long-term investment.

When that kind of capital fuels labs, AI research, clean energy breakthroughs, and chip design — you don’t just get startups, you get national champions.

Annual R&D expenditure (as % of GDP)

6. But There’s Hope — And Momentum

Despite these odds, Indian entrepreneurs are not shying away from the hard stuff.

- Startups are building SaaS for global clients.

- AI labs are emerging in Bengaluru, Hyderabad, and Pune.

- Young founders are pushing into EVs, green energy, and agri-tech — even if their first customers are overseas.

India’s consumer tech isn’t shallow — it’s just where the market is today. And as infrastructure, corporate demand, and government support improve, the story will shift.

So, What’s the Real Takeaway?

Rather than pitting samosas against semiconductors, we need to ask:

Are we building the right ecosystem for our startups to dream bigger — and actually deliver?

If we want the next BYD, DJI, or Alibaba from India, we must back them with more than applause. We need to redirect capital, reimagine procurement, and rethink policy.

Let’s not criticize the builders. Let’s fuel their fire.

Final Thought

As a partner to dozens of founders at the front lines of innovation, ProdZen sees the real challenges, trade-offs, and brilliance in the Indian startup journey.If we want global-scale startups, let’s not just set higher expectations — let’s build the scaffolding that supports them.

What do you think? Are Indian startups being judged too harshly — or is this the wake-up call we needed?